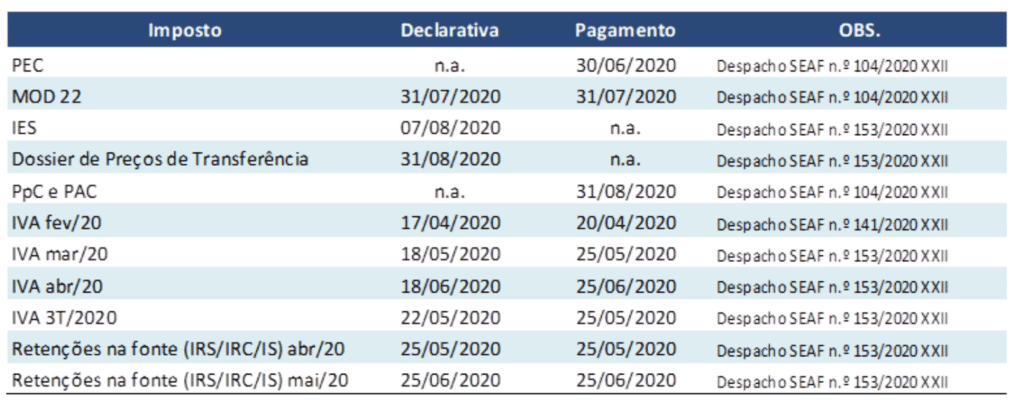

Only for certain declaratory and tax obligations.

The Government has extended the deadline for compliance with declaratory and tax obligations without any increases or penalties, and the following measures with immediate effect are implemented:

- Postponement of the 1st PEC from 31 March to 30 June 2020;

- Extension of the delivery of Model 22 (IRC Declaration + Payment/settlement) for 2019 to July 31, 2020;

- Extension of the 1st payment on account and 1st additional payment on behalf from 31 July to 31 August 2020;

- Strengthening information on electronic services that can be used by taxpayers as an alternative to going to finance services in person.

- Postponement of the deadline for sending the periodic VAT return for February 2020 and the deadline for delivery of the tax

Order No. 141/2020-XXII of 6 April provides that, without any additions or penalties, the periodic VAT returns to be delivered within the legal period provided for in Article 41(1). ° of the CIVA, for the period of February 2020, may be submitted by April 17. The delivery of the chargeable tax resulting from the periodic declarations referred to in the preceding paragraph may be made by 20 April, without prejudice to the accession to the payment scheme in instalments which is applicable.

The Payment of IRC and RETAINED IRS for February 2020 remained until 20/03/2020.

Segue o calendário fiscal com referência às novas datas para os próximos meses: