The parent who has to stay at home with their children, up to 12 years, or without age limit in the case of a child with a disability or chronic disease, due to the suspension of classroom and non-school activities in a school or social equipment to support early childhood or disability and which cannot use teleworking, will have the fault considered as justified and may receive exceptional financial support.

Exceptional financial support is due during the period in which school closure is ordered, but will not be due in the periods of fixed school interruptions (“school holidays”) that can be found in the link.

In cases where the worker cannot use telework in order to benefit from this support, the worker must complete the “Declaration of the Employee- Closure of Educational Establishment or Social Equipment to Support Early Childhood or Disability”, available on the link and deliver to the employer.

In turn, the employer, after atingtests that there are no conditions for telework, must fill out the form itself, to be made available by Social Security, and send through the Social Security,from March 30, should also register the IBAN for the purpose of payment of support by social security.

Outstanding Family Support for Employees and Self-Employed Persons shall be required on the following dates:

- for the month of April – from 1 to 10 May;

- for the month of May – from 1 to 10 June;

- june – from 1 to 10 July.

Days for child care during school closures are not counted within 30 days available for child care.

Support is in force until there is a resumption of classroom and non-school activities.

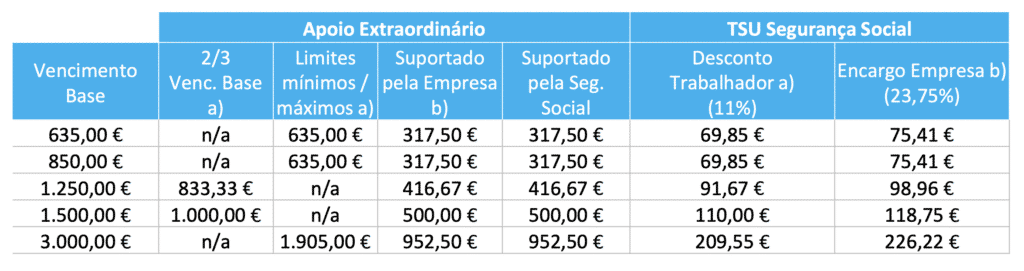

Exceptional financial support corresponds to 2/3 of the basic remuneration,which is supported in equal parts by the employer and Social Security.

The share relating to social security is handed over to the employer and the employer pays the entire employee.

This support has as minimum value 635€ (1 national minimum wage) and as a maximum value 1,905€ (3 x the national minimum wage), being therefore the maximum amount supported by social security of 952.5 euros (1.5 national minimum wage).

On the value of support are due contributions of the worker to social security, general rule of 11; employer to bear 50 of the charge with the amount paid. Examples:

Important notes:

- In the event that one parent is on teleworking, the other may not benefit from this support;

- If during school closure, the child becomes ill, the payment of the exceptional family support benefit is suspended and the general child care scheme applies.

For the purposes of the support will be considered the basic maturity received in February 2020 and communicated to the Mon. Social.

In the absence of reported value, the amount of the minimum monthly guaranteed remuneration will be considered.

If the worker has more than one employer, the measurement of the ceiling is considered to be the sum of the declared basic remuneration, and the support to be paid is distributed proportionally depending on the weight of the basic remuneration declared by each employer.