In order to mitigate the negative effects of COVID-19 on economic activity in Portugal, the Government has adopted a set of aid measures for companies:

Capitalize Line – COVID-19

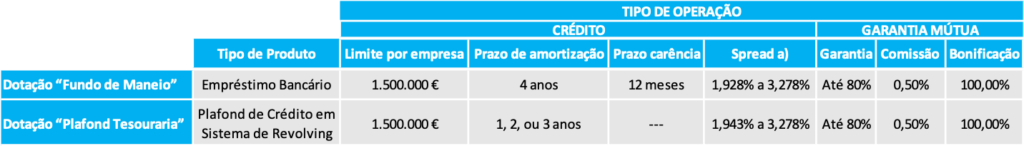

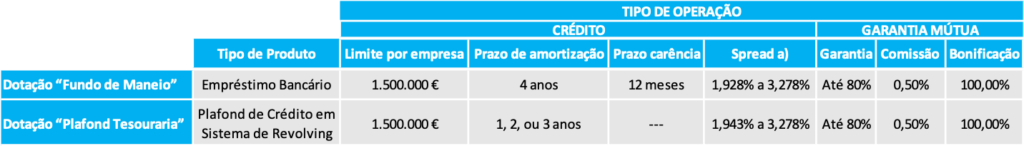

The Capitalize Line – Covid-19 was launched to support companies whose activity is affected by the economic effects of the outbreak. With an allocation of EUR 400 million for “Working Fund” and “Plafond Treasury“, this line works in a logic of approval by order of submission of applications (first come first served).

- Plafond maximum per company is 3 million euros, respectively with 1.5 million euros in the Endowment Working Fund and 1.5 million euros in the Plafond Treasury Endowment. NOTE: Companies may submit, through the same Credit Institution or several Credit Institutions, more than one transaction to each of the specific lines and/or appropriations. All the various transactions covered by each of the specific lines and/or appropriations may not exceed the maximum amounts of credit defined per company.

- Warranty up to 80, with counter-warranty of 100;

- Total guarantee fee bonus.

The following publicly supported financing solutions are available:

Capitalize Credit Line – “Covid-19 – Working Capital Fund” – Exhausted

Capitalize Credit Line – “Covid-19 – Treasury Plafond” – Sold Out

a) It depends on the type of companies and tier.

COVID-19 Economic Helpline

Applications are open to the COVID-19 Economic Support Line, a financial instrument that allows Portuguese companies in the sectors most affected by the new coronavirus pandemic to finance, under better price and term conditions, their treasury needs.

With an overall allocation of EUR 3 billion, this line is for Micro, Small and Medium-sized Enterprises, certified by the IAPMEI Electronic Declaration, as well as Small Mid Cap and Mid Cap, located in national territory, which develop activity framed in the specific list of CAE (contained in pages 35 to 40 of the Disclosure Document), and provides the following specific lines:

- Support for Economic Activity \ Allocation of 4,500 M€ (Link)

It replaces the Covid Industry Line, expanding the sectors of activity covered and the conditions of access. - Covid Restoration Line \ Endowment of 600 M€ (Link)

- Line Covid Tourism (Developments and Accommodation) \ Total endowment of 900 M€ (Link)

- Covid Line – Tourism (Travel Agencies, Tourist Animation and Event Organization) \ Total allocation of 200 M€ (Link)

The overall allocation of the COVID-19 Economic Support Line rose from EUR 3 billion to EUR 6,200 million.

The credit operations to be concluded under these lines are translated into short- and medium-term bank loans and are intended exclusively for the financing of cash requirements.

Recipients:

- Microenterprises, SMEs, Small Mid Cap and Mid Cap with:

- Positive net situation in the last approved balance sheet; Or

- Negative net situation and regularisation in interim balance sheet approved up to the date of operation.

Conditions:

- Maximum per company: 1.5 million euros (microenterprises 50 thousand €; small enterprises 500 thousand €; another 150 thousand €) with the possibility of submitting an application to more than one specific line;

- Mutual guarantee: up to 90 of the outstanding capital;

- Grace period: up to 1 year;

- Term of operations: 4 years;

- Applications from the participating banks, until December 31, 2020.

Tourism Measures of Portugal:

a) Treasury Support Line for Tourism Microenterprises

This Line is a new financial mechanism that aims to respond to the immediate and pressing financing needs of micro-enterprises, safeguarding their full activity and their human capital. Link

The line’s allocation amounts to EUR 60 million, and the financial support corresponds to the amount of €750 per month for each job in the company on 29 February 2020, multiplied by a period of three months up to a maximum amount of €20,000.

The financing assumes a reimbursable nature without associated interest and is reimbursed within three years with a grace period of 12 months. Benefits of equal amount have a quarterly periodicity.

Applications are submitted through a form available in the SGP – Formalization of applications.

Companies demonstrating that their activity has been adversely affected by the OUTBREAK of COVID-19 disease are eligible (by declaration on the application form).

b) Compliance with obligations before Turismo de Portugal I.P.

- Suspect the reimbursement of financial support granted in all support schemes financed by own revenues of this Institute: General Scheme of Financing of Tourism of Portugal, Support Line for Qualification of the Offer, Program Value and JESSICA Initiative. Link

- Support in the contribution of costs incurred for holding events in 2020 that are postponed or cancelled.

c) Other measures applied to Tourism

The Government has approved a set of credit lines for companies, guaranteed by the State and made available through the banking system that address the most affected sectors:

- Restoration and the like | EUR 600 million, of which EUR 270 million for micro and small enterprises;

- Travel agencies, animation companies, event organization and the like | EUR 200 million, of which EUR 75 million for micro and small enterprises;

- Resorts and tourist accommodation | EUR 900 million, of which EUR 300 million is earmarked for micro and small enterprises.

These credit lines include a 4-year repayment period, including a grace period until the end of the year.