Accounting and Reporting

Outsourcing financial accounting and reporting services is a growing global trend.

By outsourcing their financial and administrative processes, companies reduce costs and make their structures more flexible, improving their financial indicators and economic ratios; essentially, their overall performance.

We aim to provide an integrated, high-quality response that will ensure a continuous and integrated business management support service and provide decision makers and managers with greater certainty and speed in the decision-making process.

We take a flexible approach and can provide accounting services at the customer’s premises or in our offices.

Our value proposition stands out due to the integration of the many attributes present in our organisation and the degree of competence and commitment which we aim to embed in everything we do.

Moneris’ structural support and the specialisation of our accountants and consultants can bring numerous benefits to your business, from access to the most rapid and reliable information to enhanced control over the company’s monthly accounts and annual financial statements.

You will have at your disposal a set of experienced and highly specialised professionals, who will ensure that your business is always up-to-date and implementing best practices.

Accounting and reporting services

Accounting

- Execution of general and analytical accounting;

- Preparation of accounting by cost centres;

- Accounting recovery.

Financial Reporting

- Execution of general and analytical accounting;

- Preparation of financial statements in accordance with the applicable regulations;

- Preparation of statutory annual accounts;

- Interim financial statements;

- Consolidation of group or subgroup accounts.

Management support

- Monitoring of financial indicators and management support;

- Analysis and preparation of periodic management support reports;

- Budgetary control, financial analysis, preparation of financial models;

- Management reporting and supervisory entities.

Accounting and Tax Compliance

- Responsibility as a Certified Accountant;

- Preparation, delivery and review of tax returns;

- Closing work and clearance of results;

- Monthly presentation of reason balancesheets and analytical ones;

- Supervision and monitoring of accounting carried out by customer services.

Process management control and outsourcing

- Analysis and reconciliation of current accounts;

- Control of tangible and intangible fixed assets by individualized forms;

- Inventory and reconciliation of tangible fixed assets and inventories;

- Preparation of reconciliations of bank accounts;

- Outsourcing of accounts payable processes/suppliers; accounts receivable/customers and billing; treasury/payments and charges.

Share this content

Related content

Moneris at the EMBA Talks “The Turning Point to Top Leadership”

Ana Alhinho de S.Louro, Partner at Moneris, will be at the EMBA Talks «The Turning Point for Top Leadership», a…

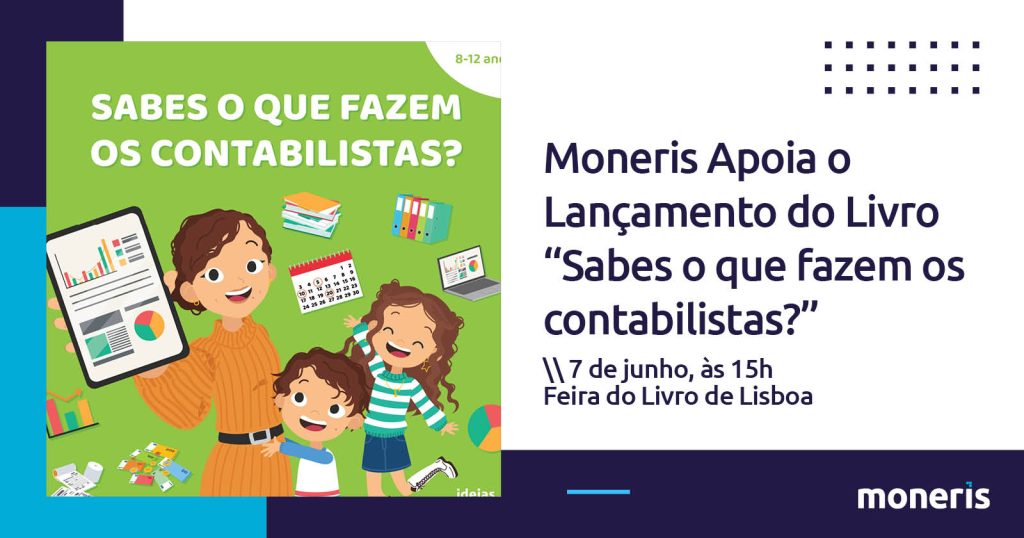

Moneris Supports the Launch of the Book “Do You Know What Accountants Do?”

As part of Moneris’ financial literacy project, we are delighted to announce our support for the launch of the book…

Moneris nominated for the Skills category at the Cegid Partner Awards 2024

This nomination aims to recognize the commitment of Cegid’s partners from different geographies in skills and training that allows them…